March 30, 2012

Read more: http://sivg.org/article/2012_TD_Bank_accused_fraud_on_court.html

By Brian Kindle

TD Bank, one of the world's largest financial institutions, is facing what may be the most explosive and

damaging risk it has ever confronted. In a federal district court in Miami, it was accused this week of

"working a fraud on the court and the jury" by doctoring a crucial document it presented in evidence at a

recent trial it lost.

The accuser and winner of the recent trial, Coquina Investments, of Texas, says the false document gave the appearance that TD Bank officially considered its former customer, Scott Rothstein, as being "Low Risk," when, in fact, the true document it withheld from the court blared "HIGH RISK."

Coquina won landmark $67 million verdict against TD Bank in January

Coquina won an unprecedented $67 million jury verdict against TD Bank in January after a 2-1/2 month trial in Miami federal court before US District Judge Marcia G. Cooke. TD Bank was found liable by an eight-person jury of having "aided and abetted fraud" by helping Rothstein, a South Florida lawyer, to perpetrate a $1.2 billion fraud and to launder the proceeds.

It is believed to be the first case in history in which a bank has been held liable of "aiding and abetting fraud" for helping a customer execute a fraud and launder the proceeds.

Rothstein curried favor with bankers with gifts

Rothstein is serving a 50-year sentence in federal prison after pleading guilty in 2010 to the fraud and laundering. He is actively cooperating with federal agents and the bankruptcy trustee in the wide ranging, international case. His testimony has not spared his former Ft. Lauderdale law partners or the TD Bank officials who received his favors and gifts, including access to a hideaway pad in Ft. Lauderdale Rothstein stocked with wine and women.

TD Bank, through spokeswoman Rebecca Acevedo, told ACFCS, "We are vigorously opposing the motion and our opposition papers will be filed very shortly."

Lawyers for TD Bank, at Greenberg Traurig, did not respond to a request for comment.

OCC has been silent on TD Bank

The Office of the Comptroller of the Currency has been monitoring the case but has not taken any regulatory action against TD Bank in the 30 months since the Rothstein scandal broke.

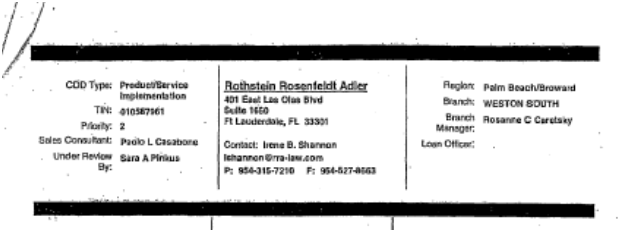

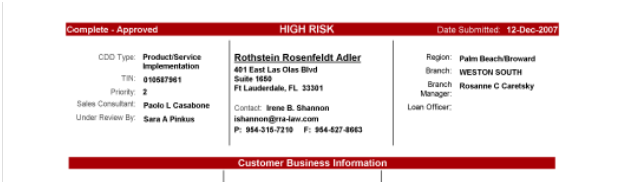

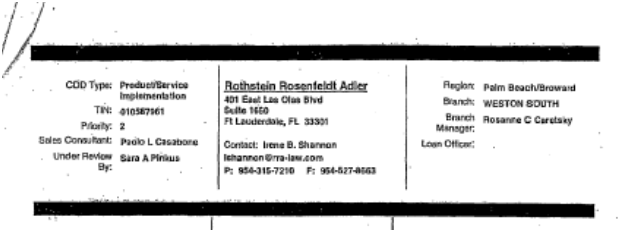

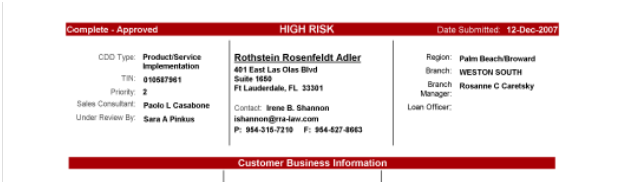

Coquina's lawyer, David Mandel, of Mandel & Mandel in Miami, who is a former federal prosecutor, said on March 26 in the "Plaintiffs Fourth Motion for Sanctions" that TD Bank and Greenberg Traurig presented as evidence a Customer Due Diligence Form for Rothstein that had been stripped of a red banner that read "HIGH RISK" in bold letters. The comments "Complete-Approved" and "Date Submitted 12-Dec-2007" flanked the banner and were also missing in the version presented in the Coquina trial. The form documented that Rothstein had been found to be a high risk for money laundering activities based on certain factors, such as total monthly check deposits and cash activity.

The form also documented that TD Bank had performed "enhanced due diligence" procedures on Rothstein, including visits to his offices and a check of commercial databases.

These procedures are mandated by regulations issued by the Treasury Department's Financial Crimes Enforcement Network (FinCEN) under the US Bank Secrecy Act (Title 31 USC, Sections 5311 et seq.)

Coquina discovered true version of "HIGH RISK" form in related case

Mandel's motion says he discovered the "fraud" when, in a different but related case, TD Bank "produced a substantially different... Customer Due Diligence Form" for Rothstein. "Even a cursory examination of the recently produced documents [in the related case] shows that... [t]he document admitted into evidence in (the Coquina) case, is a fraud," the motion for sanctions continues.

The Customer Due Diligence Form that TD Bank presented in the other case was identical to the one it presented in the Coquina case except for the "HIGH RISK" banner at the top.

The new accusations by Coquina which were presented to Judge Cooke arise after TD Bank filed its appeal of the $67 million verdict with the 11th US Circuit Court of Appeals, in Atlanta.

The simultaneous appeal and allegation of falsified evidence puts a rarely-seen wrinkle in a civil case. Judge Cooke has ample remedies at her disposal, including the imposition of monetary penalties and the striking of pleadings, but she may feel constrained by the uncertainty of what the 11th Circuit Court may decide in the appeal of the main case. The appellate court is not officially aware of the new allegations by Coquina.

Another question is what effect the true Customer Due Diligence form may have had on the jury, which ruled in favor of Coquina anyway.

Coquina asks judge for referral to Justice Department and Florida Bar

An allegation of knowingly presenting falsified records in court is extremely serious and is usually dealt with harshly by a sitting judge. In its motion, Coquina asks Cooke to take three steps:

1) To sanction TD Bank "in the manner and extent that the Court deems just and appropriate,"

2) To refer TD Bank "to the Office of the United States Attorney for investigation of potential obstruction of justice charges,"

3) To refer "Defense counsel to the Florida Bar for investigation into what role, if any, Defense counsel had in this matter."

Whatever the outcome in the 11th Circuit Court of Appeals and before Judge Cooke on the Coquina motion, it is clear the tangible and intangible costs TD Bank incurs may end up being far greater than the $67 million a Miami federal jury found it should pay to the Texas investors in Rothstein's fraudulent Ponzi scheme.

(The two versions of the top part of TD Bank's Customer Due Diligence Form for Rothstein's now-defunct firm Rothstein, Rosenfeldt and Adler appear below. The version presented in the Coquina case appears first, followed by the unexpurgated version.)

The accuser and winner of the recent trial, Coquina Investments, of Texas, says the false document gave the appearance that TD Bank officially considered its former customer, Scott Rothstein, as being "Low Risk," when, in fact, the true document it withheld from the court blared "HIGH RISK."

Coquina won landmark $67 million verdict against TD Bank in January

Coquina won an unprecedented $67 million jury verdict against TD Bank in January after a 2-1/2 month trial in Miami federal court before US District Judge Marcia G. Cooke. TD Bank was found liable by an eight-person jury of having "aided and abetted fraud" by helping Rothstein, a South Florida lawyer, to perpetrate a $1.2 billion fraud and to launder the proceeds.

It is believed to be the first case in history in which a bank has been held liable of "aiding and abetting fraud" for helping a customer execute a fraud and launder the proceeds.

Rothstein curried favor with bankers with gifts

Rothstein is serving a 50-year sentence in federal prison after pleading guilty in 2010 to the fraud and laundering. He is actively cooperating with federal agents and the bankruptcy trustee in the wide ranging, international case. His testimony has not spared his former Ft. Lauderdale law partners or the TD Bank officials who received his favors and gifts, including access to a hideaway pad in Ft. Lauderdale Rothstein stocked with wine and women.

TD Bank, through spokeswoman Rebecca Acevedo, told ACFCS, "We are vigorously opposing the motion and our opposition papers will be filed very shortly."

Lawyers for TD Bank, at Greenberg Traurig, did not respond to a request for comment.

OCC has been silent on TD Bank

The Office of the Comptroller of the Currency has been monitoring the case but has not taken any regulatory action against TD Bank in the 30 months since the Rothstein scandal broke.

Coquina's lawyer, David Mandel, of Mandel & Mandel in Miami, who is a former federal prosecutor, said on March 26 in the "Plaintiffs Fourth Motion for Sanctions" that TD Bank and Greenberg Traurig presented as evidence a Customer Due Diligence Form for Rothstein that had been stripped of a red banner that read "HIGH RISK" in bold letters. The comments "Complete-Approved" and "Date Submitted 12-Dec-2007" flanked the banner and were also missing in the version presented in the Coquina trial. The form documented that Rothstein had been found to be a high risk for money laundering activities based on certain factors, such as total monthly check deposits and cash activity.

The form also documented that TD Bank had performed "enhanced due diligence" procedures on Rothstein, including visits to his offices and a check of commercial databases.

These procedures are mandated by regulations issued by the Treasury Department's Financial Crimes Enforcement Network (FinCEN) under the US Bank Secrecy Act (Title 31 USC, Sections 5311 et seq.)

Coquina discovered true version of "HIGH RISK" form in related case

Mandel's motion says he discovered the "fraud" when, in a different but related case, TD Bank "produced a substantially different... Customer Due Diligence Form" for Rothstein. "Even a cursory examination of the recently produced documents [in the related case] shows that... [t]he document admitted into evidence in (the Coquina) case, is a fraud," the motion for sanctions continues.

The Customer Due Diligence Form that TD Bank presented in the other case was identical to the one it presented in the Coquina case except for the "HIGH RISK" banner at the top.

The new accusations by Coquina which were presented to Judge Cooke arise after TD Bank filed its appeal of the $67 million verdict with the 11th US Circuit Court of Appeals, in Atlanta.

The simultaneous appeal and allegation of falsified evidence puts a rarely-seen wrinkle in a civil case. Judge Cooke has ample remedies at her disposal, including the imposition of monetary penalties and the striking of pleadings, but she may feel constrained by the uncertainty of what the 11th Circuit Court may decide in the appeal of the main case. The appellate court is not officially aware of the new allegations by Coquina.

Another question is what effect the true Customer Due Diligence form may have had on the jury, which ruled in favor of Coquina anyway.

Coquina asks judge for referral to Justice Department and Florida Bar

An allegation of knowingly presenting falsified records in court is extremely serious and is usually dealt with harshly by a sitting judge. In its motion, Coquina asks Cooke to take three steps:

1) To sanction TD Bank "in the manner and extent that the Court deems just and appropriate,"

2) To refer TD Bank "to the Office of the United States Attorney for investigation of potential obstruction of justice charges,"

3) To refer "Defense counsel to the Florida Bar for investigation into what role, if any, Defense counsel had in this matter."

Whatever the outcome in the 11th Circuit Court of Appeals and before Judge Cooke on the Coquina motion, it is clear the tangible and intangible costs TD Bank incurs may end up being far greater than the $67 million a Miami federal jury found it should pay to the Texas investors in Rothstein's fraudulent Ponzi scheme.

(The two versions of the top part of TD Bank's Customer Due Diligence Form for Rothstein's now-defunct firm Rothstein, Rosenfeldt and Adler appear below. The version presented in the Coquina case appears first, followed by the unexpurgated version.)

Read more: http://sivg.org/article/2012_TD_Bank_accused_fraud_on_court.html

Visit the Stanford International Victims Group - SIVG official forum http://sivg.org/forum/