|

April 15, 2009

Receiver Ralph S. Janvey files this Complaint to add as relief defendants a group of financial advisors formerly

employed by Defendant Stanford Group Company ("SGC") and paid huge commissions, front-end loans, and other

compensation for soliciting their clients to purchase fraudulent certificates of deposit from SGC's affiliate,

Defendant Stanford International Bank, Ltd. ("SIB"). The U.S. Securities and Exchange Commission has alleged in

its suit against Defendants that the CDs sold to Stanford customers were not genuine investments, but rather, part

of a massive Ponzi scheme that defrauded investors out of billions of dollars. Receiver Janvey seeks to recover

more than $40,000,000 transferred to 66 financial advisors in connection with the scheme. The monies paid by Defendants to the financial advisors named herein (collectively, the "Relief Defendants") for the sale of CDs were not in payment for legitimate services rendered by Relief Defendants. The Defendants kept their fraudulent scheme going by using the Relief Defendants to lure new investors and then diverting the investors' funds to the Defendants' own illicit purposes. The commissions, loans, and other compensation paid to Relief Defendants came not from revenue generated by legitimate business activities, but from monies contributed by defrauded investors. Relief Defendants are in possession of assets traceable to Defendants' fraudulent scheme. Relief Defendants have no legitimate ownership interest in these assets; they necessarily hold the assets in trust for the Receivership Estate for the benefit of defrauded investors. The Receiver names the following Stanford Financial Group advisors as Relief Defendants. Over just a two-year period, these financial advisors received commissions ranging in amounts from $2.6 million to $200,000, along with other incentive compensation, to promote the sales of CDs. The Relief Defendants are listed here in alphabetical order: ... Read the complete Complaint here. |

|

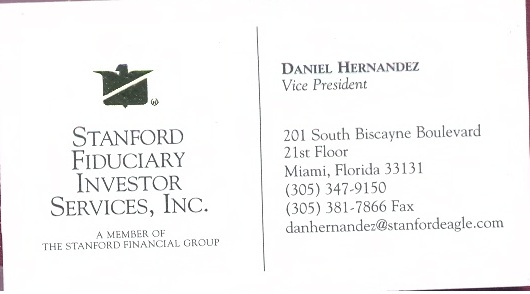

| 31. Daniel Hernandez resides at 7260 S.W. 119th Court, Miami, FL, 33183. During the period relevant to this Complaint, Hernandez was employed by SGC as a financial advisor. Between January 2007 and January 2009, Hernandez received approximately $252,032 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well as other tainted |

|

|

"compensation" traceable to the fraud. Hernandez is therefore in possession of assets that are the

rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration ... |

|

| 38. Manuel Malvaez resides at 9200 Westheimer, #1502, Houston, TX, 77063. During the period relevant to this Complaint, Malvaez was employed by SGC as a financial advisor. Between January 2007 and January 2009, Malvaez received approximately $607,192 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well as other tainted |

|

|

"compensation" traceable to the fraud. Malvaez is therefore in possession of assets that are

the rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration ... |

|

|

46. David Nanes resides at 848 Brickell Key Drive, Apt. 801, Miami, FL, 33131.

During the period relevant to this Complaint, Nanes was employed by SGC as a financial advisor. Between January

2007 and January 2009, Nanes received approximately $503,093 in fraudulent commissions traceable to Defendants'

fraudulent scheme, as well as other tainted "compensation" traceable to the fraud. Nanes is therefore in

possession of assets that are the rightful property of and should be returned to the Receivership Estate.

Additional information:

FINRA Registration ... |

|

| 52. Roberto A. Pena resides at 11420 S. Point Drive, Cooper City, FL, 33026. During the period relevant to this Complaint, Pena was employed by SGC as a financial advisor. Between January 2007 and January 2009, Pena received approximately $250,174 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well |

|

|

as other tainted "compensation" traceable to the fraud. Pena is therefore in possession of assets that are the

rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration |

|

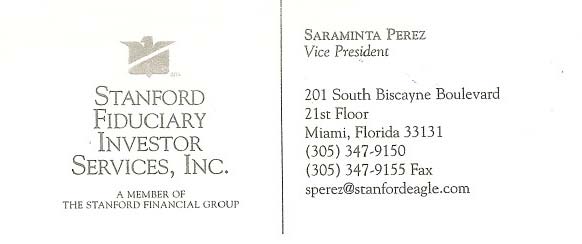

| 53. Saraminta Perez resides at 3901 S.W. 185th Avenue, Miramar, FL, 33029. During the period relevant to this Complaint, Perez was employed by SGC as a financial advisor. Between January 2007 and January 2009, Perez received approximately $369,319 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well |

|

|

as other tainted "compensation" traceable to the fraud.

Perez is therefore in possession of assets that are the rightful

property of and should be returned to the

Receivership Estate. Additional information: FINRA Registration |

|

| 54. Tony Perez resides at 12707 Boheme Drive, #602, Houston, TX, 77024. During the period relevant to this Complaint, Perez was employed by SGC as a financial advisor. Between January 2007 and January 2009, Perez received approximately $2,261,269 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well |

|

|

as other tainted "compensation" traceable to the fraud. Perez is therefore in possession of assets that are

the rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration ... |

|

| 56. Judith Quinones resides at 870 N.W. 115th Avenue, Plantation, FL, 33325. During the period relevant to this Complaint, Quinones was employed by SGC as a financial advisor. Between January 2007 and January 2009, Quinones received approximately $250,203 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well as other tainted |

|

|

"compensation" traceable to the fraud. Quinones is therefore in possession of assets that are the

rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration ... |

|

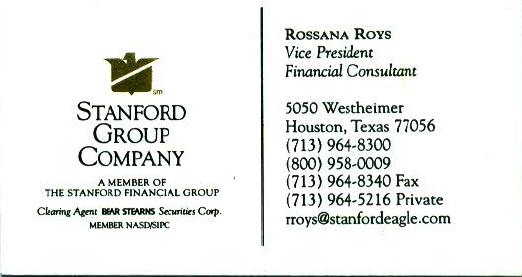

| 61. Rocky Roys (Rossana Roys) resides at 5402 China Doll Court, Houston, TX, 77041. During the period relevant to this Complaint, Roys was employed by SGC as a financial advisor. Between January 2007 and January 2009, Roys received approximately $1,243,886 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well as other tainted |

|

|

"compensation" traceable to the fraud. Roys is therefore in possession of assets that are the

rightful property of and should be returned to the Receivership Estate. Additional information:

FINRA Registration ... |

|

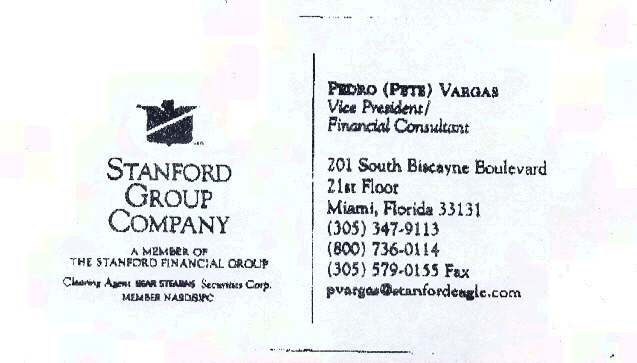

| 69. Pete Vargas resides at 13120 S.W. 33rd Court, Fort Lauderdale, FL, 33330. During the period relevant to this Complaint, Vargas was employed by SGC as a financial advisor. Between January 2007 and January 2009, Vargas received approximately $837,211 in fraudulent commissions traceable to Defendants' fraudulent scheme, as well |

|

|

as other tainted "compensation" traceable to the fraud. Vargas is therefore in possession of assets that

are the rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration ... |

|

|

Source. |

|

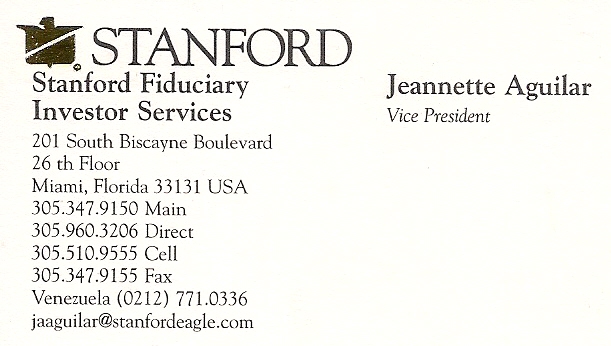

| 3. Jeannette Aguilar: US$ 77,751 - SIBL CD Commissions; US$ 77,390 - SIBL Quarterly Bonuses; Total CD Proceeds = US$ 155,142. Jeannette Aguilar is therefore in possession of assets that are the rightful property of and should be returned to the Receivership Estate. |

|

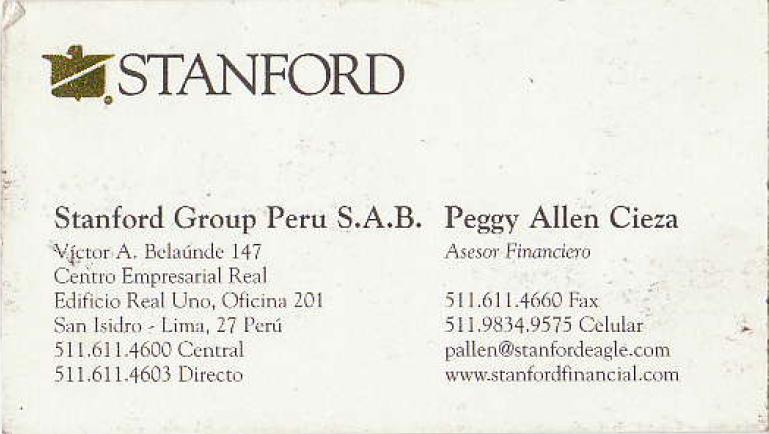

| 5. Peggy Allen: US$ 1,566 - SIBL CD Commissions; US$ 99,716 - SIBL Quarterly Bonuses; Total CD Proceeds = US$ 101,282. Peggy Allen is therefore in possession of assets that are the rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration |

|

| 29. Oswaldo Bencomo: FINRA Registration | |

| 51. Irene Vilagut: Total Proceeds from Former Employee Investor's CD(s); US$ 100,761.73. Irene Vilagut is therefore in possession of assets that are the rightful property of and should be returned to the Receivership Estate. |

|

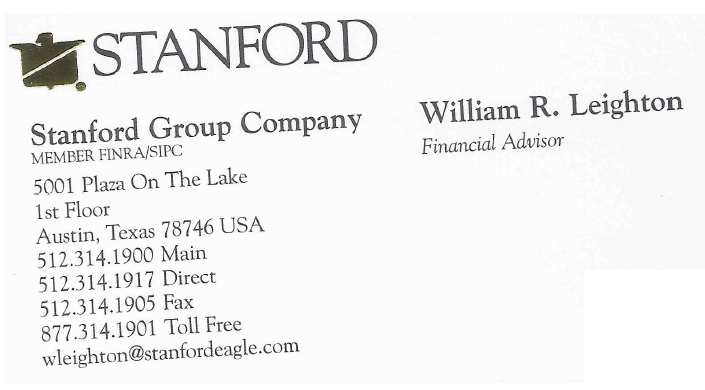

| 163. William Leighton: Total Proceeds from Former Employee Investor's CD(s); US$ 286,929. William Leighton is therefore in possession of assets that are the rightful property of and should be returned to the Receivership Estate. Additional information: FINRA Registration |

|

| 166. Humberto Lepage: FINRA Registration | |

|

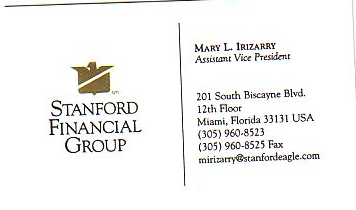

To be

considered as further examples that there was no differentiation between

each one of Stanford's companies and all Stanford companies

must be consolidated as a "one company" under the protection

of the SIPC/SIPA.

|

|

| Mary L. Irizarry: Business Card - Assistant Vice President of Stanford Financial Group. |

|

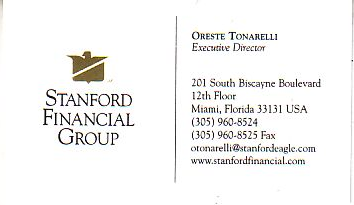

| Oreste Tonarelli: Business Card - Executive Director of Stanford Financial Group. FINRA Registration |

|

| Oreste Tonarelli: Business Card - Director of Stanford Group Company. FINRA Registration |

|

Visit the Stanford International Victims Group - SIVG official forum http://sivg.org/forum/

Keine Kommentare:

Kommentar veröffentlichen