A Reuters examination of his case finds that the answer

lay in part in the legal advice he obtained from former SEC

officials and other ex-regulators and law-enforcement

officials.

Among those Stanford sought help from was famed securities lawyer

Thomas Sjoblom. Then a partner at the international law firm of

Proskauer Rose and chair of its securities practice, Sjoblom also was a former 20-year veteran of the U.S.

Securities and Exchange Commission's enforcement division.

What Sjoblom allegedly did next for Stanford has drawn the

scrutiny of federal prosecutors. The Justice Department has

been investigating Sjoblom for possible obstruction of

justice, witness tampering, and conspiracy related to his efforts

to persuade the SEC to stand down from its investigation

of Stanford, according to people familiar with the probe.

Sjoblom is one of the most senior attorneys ever to be

investigated for allegedly crossing the line from legal advocacy

on behalf of a client to violating the law. He hasn't been

charged, however, and it is possible he never will be.

Stanford went on trial on Monday in federal court in

Houston on charges that he defrauded more than 30,000 investors from

more than 113 countries, and also obstructed the SEC's

investigation of him. Only Bernard Madoff is alleged to have stolen

more. Stanford has pleaded not guilty.

Prosecutors are likely, in making the obstruction portion

of their case against Stanford, to detail Sjoblom's alleged role

in assisting Stanford in that effort. Attorneys began

their opening arguments on Tuesday.

IMMUNITY SOUGHT, AND REJECTED

People with first-hand knowledge of the matter say that

Sjoblom had offered the Justice Department his testimony against

Stanford in exchange for a grant of immunity from

prosecution for himself - an offer rejected by the Justice Department.

Prosecutors demanded a formal acknowledgment by Sjoblom of

his own alleged criminal participation in an attempt by

Stanford to derail investigations by the SEC, according to

people involved in the discussions.

Sjoblom declined to answer questions when reached by telephone as well as inquiries submitted to him by email.

Ordinarily, attorneys are precluded from being witnesses

against former clients because of the attorney-client privilege.

But under a legal doctrine known as the crime-fraud

exception, an attorney can tell what he knows if his client has sought

advice that would abet the commission of that fraud or

some other criminal act - or in rare instances, if the attorney

himself aided a crime. The crime or fraud disclosed or

discussed must also then occur for the attorney to be able to

testify. If Sjoblom had testified against Stanford, he

would have been one of the most prominent attorneys to turn against

such a client.

THE STANFORD EIGHT

The trials could cast light on the broader mystery of how

the alleged Stanford fraud could have gone on so long even

though federal regulators were examining the Texas

financier for years. The case has put the SEC and other federal

agencies in an embarrassing light, creating fresh fodder

for critics of the revolving door between government and the

private sector.

Stanford, Reuters has found, paid at least eight former

senior U.S. and foreign regulators and law-enforcement officials

for legal advice or investigative services.

Among the former government figures who worked for

Stanford is Spencer C. Barasch, who headed the enforcement division of

the SEC's office in Ft. Worth, Texas.

Barasch agreed this month to pay a $50,000 fine for

allegedly violating federal ethics laws by representing Stanford after

overseeing regulation of Stanford's U.S. brokerage

businesses. It is illegal for many former federal regulators, including

those at the SEC, to represent private clients if they

have "personally and substantially" participated in any matters

related to those clients during the course of their

government employment.

Examiners at the SEC had suspected as early as 1997 that

Stanford was engaged in a Ponzi scheme and felt the SEC should

investigate. But year after year, until 2005, their

warnings and calls for investigation were ignored by higher-ups.

A FRIEND IN FT. WORTH

In January 2009, the SEC was seeking the sworn testimony

of both Stanford and James Davis, the chief financial officer

for Stanford International Bank. Davis, Stanford's top

deputy, has since pled guilty to securities-fraud and mail-fraud

charges and has become a government witness against

Stanford and others.

Stanford sought to delay and wear down regulators and

investigators, Davis and other witnesses told the government,

according to a 2009 plea agreement between Davis and

federal prosecutors filed in federal court in Houston.

In 1997, 1998, 2002, 2004, and 2005, according to internal

agency records seen by Reuters, examiners for the SEC

recommended that the agency investigate Stanford. In three

of those instances, Barasch, at the time an SEC official in

Ft. Worth, personally overruled the examiners'

recommendations, according to those records. Those decisions helped the

Ponzi scheme to continue unabated for several additional

years, costing investors additional billions of dollars,

according to a report by the SEC's Inspector General.

Barasch told the SEC Inspector General that he made those

decisions because he was not sure the SEC had the statutory

authority or jurisdiction to investigate. He blamed his

superiors and a broader culture within the SEC for pressuring

the staff not to pursue complex and difficult cases,

according to the Inspector General report.

In his final days at the SEC in 2005, Barasch overruled

examiners one last time on a request to investigate Stanford,

according to the Inspector General report and interviews

with SEC officials. The SEC's formal investigation of Stanford

began exactly one day after Barasch left the agency.

Barasch referred questions to his lawyer; his attorney didn't respond to requests for comment.

REVOLVING DOOR

"This misconduct highlights the dangers of a 'revolving

door' environment between the SEC and the private securities law

bar," outgoing SEC Inspector General H. David Kotz said in

statement about the Barasch case.

The Justice Department's agreement with Barasch was

reported by Reuters earlier this month. The SEC, which has the

authority to bar professionals from practicing before the

agency, has not announced any disciplinary action.

The SEC is also preparing a separate civil case against

another former regulator, Bernerd Young, who worked as a

compliance officer for Stanford's bank, said a person

familiar with the matter. Before he worked for Stanford, from 1999

to 2003, Young was a district director of the Dallas

office of the National Association of Securities Dealers, which was

then the brokerage industry's self-regulator. Regulation

of the industry has since been taken on by a successor agency,

the Financial Industry Regulatory Authority.

Young was notified by the SEC staff last June that they

were preparing a civil complaint against him for securities-law

and other violations and seeking a lifetime ban on his

employment in the securities industry, according to a person who

reviewed the SEC's notification to Young. Young hasn't

been charged with any wrongdoing.

In November 2007, the Financial Industry Regulatory

Authority charged that Stanford had used "misleading, unfair and

unbalanced information" and fined him $10,000, but with no

admission of guilt. Young was central to decisions by the NASD

not to take tougher action against Stanford, according to

government officials involved in the matter.

Randle Henderson, an attorney for Young, said Young had

"done absolutely nothing wrong" and that he and Young had been

cooperating with SEC investigators. If an enforcement

action was brought, Henderson said, he and his client would engaged

in a "full and complete and aggressive defense" of the

allegations.

THE AIRCRAFT HANGAR SESSION

Sjoblom began work for Stanford as early as 2005, as the

SEC began a formal investigation. Barasch began representing

Stanford in September 2006.

Barasch's successor at the SEC had reversed course and

given a green light for the SEC to investigate. Stanford believed

that hiring former SEC officials was the best course to

thwart the agency, according to emails written by Stanford to

subordinates and later cited by the SEC's Inspector

General.

Barasch worked on the case until December 2006, dropping

out after SEC ethics officers warned him that any further

involvement would violate a federal law.

On January 21, 2009, Stanford, his deputy Davis and other

senior executives of the Stanford International Bank met

Sjoblom in an aircraft hangar in Miami, Florida, to devise

a strategy for fending off the SEC, according to the Davis plea

agreement entered in Houston federal court.

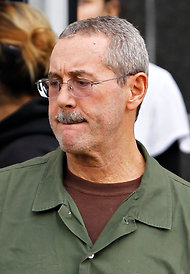

Stanford, a bulky man with a thick mustache, paced

nervously in the aircraft hangar, according to an account one of the

attendees gave to federal investigators. In contrast,

Sjoblom appeared calm and collected as they discussed their next

move, the attendee told federal investigators.

The group allegedly agreed on a strategy: Sjoblom would go

to the SEC and tell officials that both Stanford and Davis

knew very little about the business they ran. Instead, he

would tell them, two other, lower-ranking executives of the

Stanford International Bank understood much better how the

bank invested customers' money. He would then propose that

they testify in place of Stanford and Davis, according to

the plea filed in federal court in Houston.

SJOBLOM'S STRATEGY

Sjoblom knew that these assertions were false, and was also by then aware that Stanford had engaged in a massive

financial fraud, according to the Davis plea. Still, Sjoblom moved forward with the effort to obstruct the SEC

investigation, the Justice Department alleged in the Davis plea.

Early the next morning, on Jan 22, 2009, Sjoblom met in

Houston with attorneys for the SEC, according to the Davis plea.

There, Sjoblom told the SEC staff that Stanford and Davis

did not "micro-manage" clients' portfolios. Taking Sjoblom's

word, the SEC agreed to delay the testimony of Stanford

and Davis, according to the plea filed in Houston federal court.

The Justice Department has since alleged that Sjoblom's

actions constituted an obstruction of their investigation. Based

in part on information given them by Davis, federal

prosecutors alleged that Sjoblom continued trying to prevent the SEC

from learning the truth even after Sjoblom learned about

Stanford's massive fraud.

After convincing the SEC to forego Stanford's and Davis's

testimony, Sjoblom allegedly helped prepare Laura

Pendergest-Holt, Stanford International's chief investment

officer, to testify in their absence, according to the Davis

plea and an indictment against Pendergest-Holt in federal

court in Houston.

Prosecutors allege that in reality, Stanford and Davis

were the only two Stanford executives intimately familiar with the

finances of the company. Pendergest-Holt only learned the

full extent of the fraud around the same time that Sjoblom did,

when the two were preparing her to testify before the SEC,

federal prosecutors assert. Pendergest-Holt and Sjoblom learned

then that the firm was insolvent and most of its financial

claims fictional, prosecutors allege in the Pendergest-Holt

indictment and the Davis plea.

On February 5, Stanford admitted to Davis and Sjoblom that

his bank's "assets and financial health had been misrepresented

to investors, and were overstated," according to Davis's

plea agreement with prosecutors.

$4 MILLION MORE?

Instead of dropping Stanford as a client and setting the

record straight with the SEC, Sjoblom went back to Davis and

Stanford with an offer, Davis told the FBI, according to a

person familiar with the case. Sjoblom told the pair that they

both faced serious criminal jeopardy and asked each to pay

him a retainer of $2 million to represent them personally, for

a total of $4 million, this person said. That money would

have been in addition to what Stanford's firm had already paid

Sjoblom's firm. It is not clear whether the additional

money was paid.

On February 10, Pendergest-Holt gave testimony to SEC

officials. That morning, Davis admitted in his guilty plea, he

phoned Pendergest-Holt and encouraged her to lie to

"continue to obstruct the SEC investigation," according to the Davis

plea agreement.

During her testimony, Pendergest-Holt said she knew little

about the assets the SEC wanted to know about. All during her

testimony, Sjoblom sat at her side, as five attorneys from

the SEC's enforcement division fired away questions.

A federal grand jury later indicted her on obstruction of

justice and conspiracy charges related to her allegedly false

testimony. She is currently awaiting trial. Her lawyer

declined to comment.

The indictment of Pendergest-Holt also implicated Sjoblom.

"Holt, Attorney A and others would make false and misleading

statements to the SEC staff attorneys in order to persuade

them to delay" Stanford's testimony while Pendergest-Holt

would "provide false testimony," the indictment alleged.

Days after Pendergest-Holt's testimony, on February 14,

Sjoblom resigned as a lawyer for Stanford and wrote to the SEC:

"I disaffirm all prior oral and written representations

made by me and my associates to the SEC staff."

Federal prosecutors are looking to Pendergest-Holt to see

if she corroborates Davis' testimony regarding Sjoblom, and

will then decide whether to charge Sjoblom, according to

sources close to the case. (editing by Martin Howell and Michael

Williams)

|